Award-winning PDF software

How to prepare Form 1120s

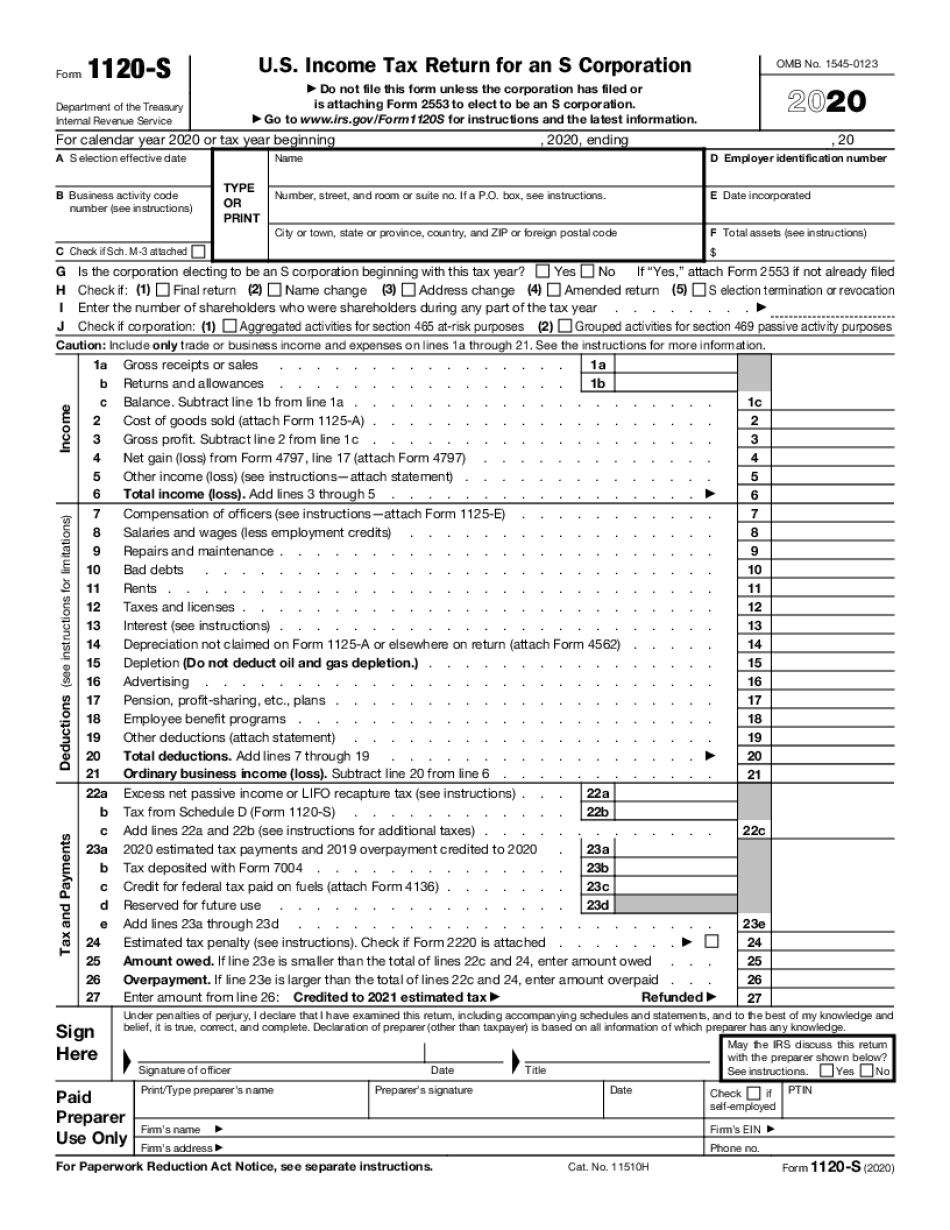

About Form 1120s

Form 1120s is a tax form used by S corporations to report their income, expenses, and other tax-related information to the Internal Revenue Service (IRS). S corporations are a specific type of business entity that pass through profit, losses, credits, and deductions to their shareholders, who then report those items on their individual tax returns. S corporations must file Form 1120s annually, providing details about their financial activities, including income from sales of products or services, interest, rent, and other sources. The form also includes sections for reporting salaries and wages paid to employees, as well as deductions and credits the corporation may be eligible for. In addition to the basic information, Form 1120s requires the S corporation to provide a schedule of shareholders, detailing their names, addresses, percentage of ownership, and other relevant information. This helps ensure accurate reporting and transparency in the distribution of profits and losses among shareholders. It is important to note that only S corporations are required to file Form 1120s. Other types of business entities, such as sole proprietorships, partnerships, and regular (C) corporations, have their own specific tax forms to report income and expenses.

Get Form 1120s and make simpler your day-to-day file administration

- Discover Form 1120s and start editing it by clicking on Get Form.

- Begin completing your form and include the details it requires.

- Take advantage of our extensive editing toolset that permits you to post notes and leave feedback, if required.

- Take a look at form and double-check if the information you filled in is correct.

- Easily correct any error you have when modifying your form or get back to the last version of your document.

- eSign your form effortlessly by drawing, typing, or taking a picture of your signature.

- Save modifications by clicking Done and after that download or distribute your form.

- Send your form by email, link-to-fill, fax, or print it.

- Select Notarize to perform this task on your form on the internet with the eNotary, if needed.

- Safely store your complete file on your PC.

Editing Form 1120s is an easy and intuitive process that requires no prior coaching. Get everything required in a single editor without constantly switching between various platforms. Discover more forms, fill out and preserve them in the formatting of your choice, and streamline your document administration in a single click. Before submitting or delivering your form, double-check information you filled in and easily correct errors if needed. In case you have questions, get in touch with our Support Team to assist you.